STOCK CASH TIPS

NIFTY SPOT: 8204.00

Nifty Future R1:8227 R2:8250 R3:8286

Pivot:8191 S1:8168 S2:8132 S3:8109

CHART INTERPRETATION

NIFTY SPOT: 8204.00

Nifty Future R1:8227 R2:8250 R3:8286

Pivot:8191 S1:8168 S2:8132 S3:8109

|

| STOCK CASH TIPS |

CHART INTERPRETATION

- Nifty closed on at 8204.00 On Wednesday. Next logical targets for nifty would be 8250-8280 and breaching of 8000 would force nifty to see levels of 7900. whereas the 8150-8200 will act as very strong resistance levels, if once it go to 8200 then there will higher probability for nifty to touch 8230-8250 levels.

- Mechanical indicator stochastic RSI also showing consolidated trend.

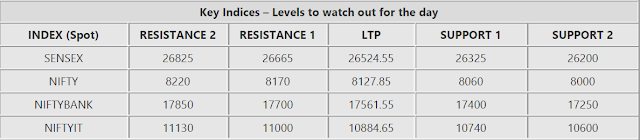

INDEX OUTLOOK

NIFTY FUTURE: The Indian stock market is trading higher on a buying build-up by participants, tracking a global rally. The Nifty and the Sensex opened marginally higher a day ahead of derivatives expiry. The BSE Sensex opened 102.60 points up at 26,627.15 while NSE Nifty opened 45.25 points up at 8.173.10. Domestic sentiment was also buoyed as the Union Cabinet has approved a proposal to revise upwards salaries and pensions for government employees. Mid-cap Index is trading up 0.93% at 11,566 whereas BSE Small-cap Index is trading up 1.21% at 11,680.

INTRADAY STRATIGY: Buy Nifty future above 8230 for the tgt of 8280-8330 sl 8160.

SECTORIAL INDICES

CORPORATE NEWS

If you want to more information regarding the Stock cash tips, Stock tips, Nifty tips, Commodity tips, Equity tips call @ 8109999233 or fill form http://equityresearchlab.com/Freetrial.phpSECTORIAL INDICES

CORPORATE NEWS

- DLF shares rallied by 7.8% after its promoter KP Singh announced his plans to make the company debt free. The promoter plans to infuse capital worth Rs. 10,000 crores by purchasing shares in a preferential issue.

- The cabinet approved the 7th Pay Commission Scheme which seeks to give pay hikes to employees of the Government. Shares of Consumer Goods and Auto Sector companies went up on the expectations of higher demand.

- Shares of Auto Ancillaries Company, BOSCH, went up by 5.9% after the company’s board announced plans to buy back shares.