STOCK FUTURES TIPS:-

NIFTY FUTURE : R1:8843 R2:8892 R3:8979

PIVOT :8755 S1:8706 S2:8619 S3:8570

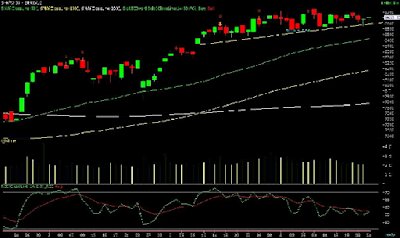

CHART INTERPRETATION

NIFTY FUTURE: The Indian stock market is trading on a steady note maintaining over half a percent gain as investors continue to pile up hefty positions almost across the counters. European stocks climbed, extending a monthly advance, as a weaker euro boosted exporters. The BSE Mid-cap Index is trading up 0.76% at 13,164 whereas BSE Small-cap Index is trading up 1.05% at 12,629. The INDIA VIX is down 2.22% at 12.8725. Some buying activity is seen in auto, IT, banking, metal, oil & gas, FMCG, pharma and finance sectors, while telecom sector is showing weakness on BSE.

STRATEGY: Buy Nifty Future above 8800 for the target of 8850 -8950 with the stop loss of 8730.

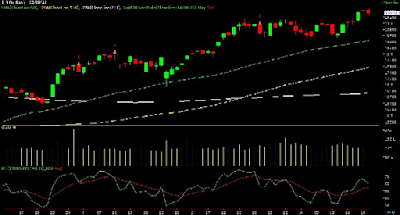

NIFTY FUTURE : R1:8843 R2:8892 R3:8979

PIVOT :8755 S1:8706 S2:8619 S3:8570

|

| stock future tips |

CHART INTERPRETATION

- The only strategy for the traders should be to hold long positions or initiate fresh long positions at every dip in the market. And Expectations of a good monsoon have once again reinforced the confidence among market participants that the growth may come back on a good note, timely onset of the monsoons will be a positive for the markets. A strong break below 8600 will increase the downside pressure and drag it to 8400/8300. Traders can go short on a break below 8600.On the other hand, a decisive break above 8820 will ease the downside pressure and take the index futures higher to 8900 and 8950 there after.

- Mechanical indicator stochastic RSI also showing consolidated trend.

NIFTY FUTURE: The Indian stock market is trading on a steady note maintaining over half a percent gain as investors continue to pile up hefty positions almost across the counters. European stocks climbed, extending a monthly advance, as a weaker euro boosted exporters. The BSE Mid-cap Index is trading up 0.76% at 13,164 whereas BSE Small-cap Index is trading up 1.05% at 12,629. The INDIA VIX is down 2.22% at 12.8725. Some buying activity is seen in auto, IT, banking, metal, oil & gas, FMCG, pharma and finance sectors, while telecom sector is showing weakness on BSE.

STRATEGY: Buy Nifty Future above 8800 for the target of 8850 -8950 with the stop loss of 8730.

SECTORIAL INDICES

CORPORATE NEWS

- Ramky Infrastructure and Ashoka Buildcon secured road projects worth Rs. 700 Cr and Rs. 946 Cr respectively from the National Highway Authority of India (NHAI). The projects are based in Jharkhand and deal with road widening of NH32 and NH33.

- Energy Solutions Company – Crompton Greaves reported a Net profit of Rs. 40 Cr in Q1, as against a loss of Rs. 63.7 Cr in the corresponding period last fiscal. Revenue increased by 38.6% to Rs. 1,423.8 Cr in the quarter as compared to Rs. 1,027.5 Cr previously.

- Whirlpool reported a 25.9% rise in Net profit to Rs. 122 Cr for Q1 as compared to Rs. 96.8 Cr in the corresponding quarter last fiscal. Total income from operations stood at Rs. 1,406.3 Cr, up by 17.1%, from Rs. 1,200.5 Cr previously.

If you want to more information regarding the Stock cash tips, Stock tips,Stock futures tips, Stock futures services, Equity tips call @ 8109999233 or fill form http://equityresearchlab.com/Freetrial.php