STOCK FUTURES TIPS:-

If you want to more information regarding the Stock cash tips, Stock tips, Nifty tips, Commodity tips, Equity tips call @ 8109999233 or fill form http://equityresearchlab.com/Freetrial.php please drop your number for profit calls....

|

| stock future tips |

- The BSE Mid-cap Index is trading up 1.16% at 12,043, whereas BSE Small-cap Index is trading up 1.02% at 12,076. Aurobindo Pharma, ICICI Bank, BHEL, ITC and Grasim are among the gainers, whereas BPCL, Bharti Airtel, Bharti Infratel, Tata Motors and HDFC Bank are losing sheen on NSE.

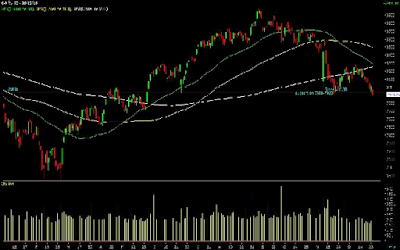

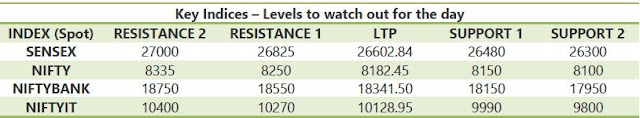

- The Indian stock markets with the benchmarks advancing to their highest level in two-weeks. Nifty50 hits 8,150 mark on Friday. Market sentiment was also boosted after Finance Minister Arun Jaitley said that government tax collection has gone up sharply, belying fears of sharp slowdown in the economy.

- At 10:57 AM, the S&P BSE Sensex is trading at 26,579 up 213 points, while NSE Nifty is trading at 8,163 up 59 points.

- The BSE Mid-cap Index is trading up 1.16% at 12,043, whereas BSE Small-cap Index is trading up 1.02% at 12,076.

- Aurobindo Pharma, ICICI Bank, BHEL, ITC and Grasim are among the gainers, whereas BPCL, Bharti Airtel, Bharti Infratel, Tata Motors and HDFC Bank are losing sheen on NSE.

- A total of four stocks registered a fresh 52-week high in trade today, while seven stocks touched a new 52-week low on the NSE.

- Out of 1,828 stocks traded on the NSE, 357 declined, 1,026 advanced and 445 remained unchanged today.

- Some buying is observed in industrial, financial services, IT, banking, metal, power, realty and auto sectors while telecom is showing weakness on BSE.

- The INDIA VIX is down 1.06% at 15.1200.

- Tree House Education surged over 5% to Rs 18.25 after the company informed exchanges that a meeting of the board of director is scheduled to be held on Friday to consider and approve appointment of Suraj Manghnani as an additional independent non-executive director.

- Jagran Prakashan also surged over 5% to Rs 184.65 after the company said the meeting of the board of directors is scheduled to be held on Jan 5, to consider the proposal for buyback of shares.

- Most Asian indices opened flat with the Japanese 'Nikkei" trading in the green. The deadline to exchange old high value currency notes comes to an end today and the attention is on what Prime Minister Narendra Modi will unleash in his much anticipated speech on the eve of New Year. Reports indicate that the inconveniences of the demonetisation may soon be history as the PM is set to announce a host of measures that will propel the economy back on the growth track. The FM sought to assuage any fears by throwing up facts stating that November saw a rise in tax collection; an increase in rabi sowing, higher air traffic and increased insurance premiums.

- The government is proposing a staggered relaxation of existing restrictions on cash withdrawals from banks after 30 December. This is aimed at smoothening the transition as the Reserve Bank of India (RBI) supplies new currency notes.

- The banking sector continues to face “significant” levels of stress but the financial system remains stable overall after moves to enhance transparency, Reserve Bank of India (RBI) governor Urjit Patel said in the biannual Financial Stability Report.

If you want to more information regarding the Stock cash tips, Stock tips, Nifty tips, Commodity tips, Equity tips call @ 8109999233 or fill form http://equityresearchlab.com/Freetrial.php please drop your number for profit calls....