STOCK FUTURES TIPS:-

NIFTY FUTURE : R1:7955 R2:7999 R3:8029

PIVOT :7925 S1:7881 S2:7852 S3:7808

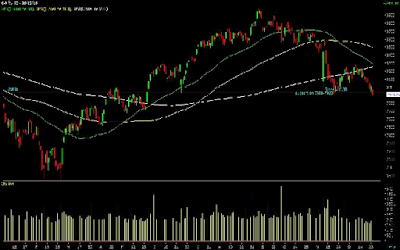

CHART INTERPRETATION

NIFTY FUTURE : R1:7955 R2:7999 R3:8029

PIVOT :7925 S1:7881 S2:7852 S3:7808

|

| stock future tips |

CHART INTERPRETATION

- Technically, A strong break below 8000 will increase the downside pressure and drag it to 7900/7800. Traders can go short on a break below 8000.On the other hand, a decisive break above 8200 will ease the downside pressure and take the index futures higher to 8300 and 8350 thereafter. MACD and Price ROC are both negative and continue in sell mode. RSI (40) suggests bearish momentum. This week, the indices tested the short term average of 22dma Nifty – 8242 but could not close above it. the indices continue to remain below the medium term average of 50dma Nifty – 8430 but above the long term average of 200dma Nifty – 7600. Thus the trend in the short term and medium term timeframe remains bearish whereas the trend in the long term timeframe still continues to remain Bullish.

- MACD and Price ROC are both negative and continue in sell mode. RSI (40) suggests bearish momentum.

NIFTY FUTURE: The Indian Market expected to remain volatile ahead of the expiry of December series F&O contracts, as investors roll over their positions to the January series. The near month contracts will expire on the coming December 29. Sensex ended with a loss of 234 points at 25,807, While Nifty closed with a loss of 77.50 points at 7,908. Nifty fell about 1% on Monday to a seven-month low weighed by metal, realty, pharma, banking and auto stocks. The BSE Midcap and Smallcap closed down by 2% each. The India VIX, jumped 12% to 16.9050 points after Narendra Modi's comments on stock market's contribution to the government on Friday spooked traders. Finally it settled at 14.2350 up by 9.75%. The Rupee was trading up four paise at 67.78 per US dollar. On the global front, Asian markets were trading mixed. China’s Shanghai Composite index fell 0.84% to 3,279 on Monday morning, while Japan’s Nikkei fell 0.09% to 19,412. Major global markets remained shut on account of Christmas and Boxing Day holidays. In Europe, the FTSE 100 and CAC 40 were trading marginally higher, while DAX is trading in red.

STRATEGY: Buy Nifty Future above 7920 for the target of 7970 -8020 with the stop loss of 7850.

SECTORIAL INDICES

- Lupin received tentative approval for its anti-hypersensitive drug Olmesartan Medoximil (5 mg, 20 mg and 40mg) from the United States Food and Drug Administration (FDA) to market in the US.

- ONGC announced that it will buy debt-ridden Gujarat State Petroleum Corporation's entire 80% stake in KG basin natural gas block for an amount of $1.2 billion. Shares closed down 2.1%.

- Larsen & Toubro’s construction arm secured projects worth a total of Rs. 3,039 Cr. The water & effluent treatment business segment won orders worth Rs. 1,422 Cr. The power transmission & distribution business segment secured major orders worth Rs. 1,036 Cr. The heavy civil infrastructure and metallurgical material handling segments secured orders worth Rs. 359 Cr and Rs. 222 Cr respectively.

If you want to more information regarding the Stock cash tips, Stock tips,Stock futures tips, Stock futures services, Equity tips call @ 8109999233 or fill form http://equityresearchlab.com/Freetrial.php

0 comments:

Post a Comment