STOCK FUTURES TIPS:-

NIFTY FUTURE : R1:8679 R2:8725 R3:8757

PIVOT :8647 S1:8601 S2:8569 S3:8523

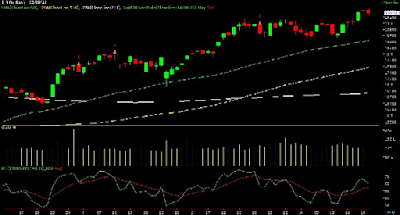

CHART INTERPRETATION

NIFTY FUTURE: The Indian equity market ended with losses for second consecutive trading session on Monday. Weak global cues, profit booking and a weak rupee dampened the sentiment. Urjit Patel’s appointment as the new RBI Governor too failed to bring any cheer on the street. The new governor will take charge for a 3 year term from 4 September 2016 .Market participants were also jittery as they await the speech by Fed chair Janet Yellen at an annual summer gathering in Jackson Hole, for indications of how policymakers view the interest rates outlook. Heavy selling pressure was witnessed in IT, auto, pharma, metal, power and banking stocks, while FMCG and consumer durables stocks were among the gainer. The rupee was trading down 14 paise at 67.20 per US dollar.

STRATEGY: Buy Nifty Future above 8640 for the target of 8690 -8740 with the stop loss of 8570.

NIFTY FUTURE : R1:8679 R2:8725 R3:8757

PIVOT :8647 S1:8601 S2:8569 S3:8523

|

| stock future tips |

CHART INTERPRETATION

- The only strategy for the traders should be to hold long positions or initiate fresh long positions at every dip in the market. And Expectations of a good monsoon have once again reinforced the confidence among market participants that the growth may come back on a good note, timely onset of the monsoons will be a positive for the markets. A strong break below 8500 will increase the downside pressure and drag it to 8400/8300. Traders can go short on a break below 8500.On the other hand, a decisive break above 8635 will ease the downside pressure and take the index futures higher to 8750 and 8900 there after.

- Mechanical indicator stochastic RSI also showing consolidated trend.

NIFTY FUTURE: The Indian equity market ended with losses for second consecutive trading session on Monday. Weak global cues, profit booking and a weak rupee dampened the sentiment. Urjit Patel’s appointment as the new RBI Governor too failed to bring any cheer on the street. The new governor will take charge for a 3 year term from 4 September 2016 .Market participants were also jittery as they await the speech by Fed chair Janet Yellen at an annual summer gathering in Jackson Hole, for indications of how policymakers view the interest rates outlook. Heavy selling pressure was witnessed in IT, auto, pharma, metal, power and banking stocks, while FMCG and consumer durables stocks were among the gainer. The rupee was trading down 14 paise at 67.20 per US dollar.

STRATEGY: Buy Nifty Future above 8640 for the target of 8690 -8740 with the stop loss of 8570.

SECTORIAL INDICES

CORPORATE NEWS

- NTPC reported a 4.1% YoY growth in net profit for Q1 to Rs. 2,369.5 Cr, as against Rs. 2,276.5 Cr in the same period last fiscal. Revenue stood at Rs. 19,063 Cr for the quarter as compared to 17,093 Cr previously, up by 11.5% YoY.

- Shares of Textile Company – Welspun India Limited fell by 20% after its second biggest client, Target Corp, announced that it was terminating its business with the textile company. Target Corp stated the reason of the termination that Welspun India had substituted Egyptian cotton with a cheaper variant of cotton while supplying it bedsheets.

- Indraprastha Gas Limited reported a 44.4% YoY increase in Net profit for Q1FY17 to Rs. 148 Cr as compared to Rs. 102.5 Cr in the same period last year. Income from Operations stayed flat at Rs. 899.6 Cr as compared to Rs. 901.7 Cr previously.

If you want to more information regarding the Stock cash tips, Stock tips,Stock futures tips, Stock futures services, Equity tips call @ 8109999233 or fill form http://equityresearchlab.com/Freetrial.php

0 comments:

Post a Comment