STOCK FUTURES TIPS:-

NIFTY SPOT : R1:9337 R2:9370 R3:9397

PIVOT : 9309 S1:9276 S2:9249 S3:9216

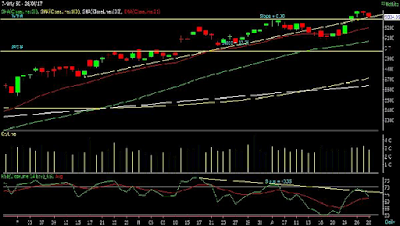

CHART INTERPRETATION

The Nifty took support precisely near the cluster of support placed around 9060-9070 region as it is the upper band of bullish gap area formed on March 14, 2017 post state election results (9060) and 80% retracement of the last rising segment placed around 9070. Going forward, we expect the index to trade with a positive bias and a decisive close above 9310 will add fuel to the ongoing momentum and open further upsides towards 9450 over the short term as it is the value of the trend line joining 2016 yearly high and March 2017 peak of 9218. Among oscillators, the 14 period RSI is exhibiting a negative divergence as it has formed lower high against higher high on price front. This may keep the index vulnerable to bouts of profit taking at higher levels

NIFTY SPOT : R1:9337 R2:9370 R3:9397

PIVOT : 9309 S1:9276 S2:9249 S3:9216

|

| stock future tips |

The Nifty took support precisely near the cluster of support placed around 9060-9070 region as it is the upper band of bullish gap area formed on March 14, 2017 post state election results (9060) and 80% retracement of the last rising segment placed around 9070. Going forward, we expect the index to trade with a positive bias and a decisive close above 9310 will add fuel to the ongoing momentum and open further upsides towards 9450 over the short term as it is the value of the trend line joining 2016 yearly high and March 2017 peak of 9218. Among oscillators, the 14 period RSI is exhibiting a negative divergence as it has formed lower high against higher high on price front. This may keep the index vulnerable to bouts of profit taking at higher levels

INDEX OUTLOOK

Nifty Future: The Nifty is likely to open flat on the back of mixed global cues. Its important to sustain above 9310-3335 to move upwards. Sell Nifty near 9330-3340 for targets of 9300,9275 stop loss: 9360 Nifty Bank Future: The index continued to end near its all-time high levels with decent rolls for the next series. Looking at the overall options data, the index is likely to trade in a broader range in coming days. A surge in IVs can also be seen. Buy Nifty Bank in the range of 22000-22050, targets: 22150-22250, stop loss: 21940

Nifty Future: The Nifty is likely to open flat on the back of mixed global cues. Its important to sustain above 9310-3335 to move upwards. Sell Nifty near 9330-3340 for targets of 9300,9275 stop loss: 9360 Nifty Bank Future: The index continued to end near its all-time high levels with decent rolls for the next series. Looking at the overall options data, the index is likely to trade in a broader range in coming days. A surge in IVs can also be seen. Buy Nifty Bank in the range of 22000-22050, targets: 22150-22250, stop loss: 21940

SECTORIAL INDICES

CORPORATE NEWS

- Ujjivan Financial Services reported dismal Q4FY17 results as Net interest income declined 33.3% to Rs. 152.8 cr against Rs. 229 cr in the last quarter. The company’s consolidated Net profit was down 56% at Rs. 19.3 cr compared to Rs. 43.9 cr in Q3FY17.

- Syngene International showed poor Q4 performance, where the company's profit was down 0.8% at Rs 78.4 cr versus Rs 79 cr (Y-o-Y). EBITDA of Syngene was down 14.5% at Rs 100.4 cr against Rs 117.4 cr, whereas EBITDA margin stood at 34.5% versus 35.4% (Y-o-Y). Revenue was down 12.1% at Rs 291.3 cr compared to Rs 331.5 cr in the same period of the previous year.

- Prism Cement got the letter of intent from the Madhya Pradesh government for allotment of cement grade limestone mining lease. The lease is for a period of 50 years with reserves of 23.6 MT. The mining lease will be captive to cement plant of the company at Satna (MP).

If you want to more information regarding the Stock cash tips, Stock tips,Stock futures tips, Stock futures services, Equity tips call @ 8109999233 or fill form http://equityresearchlab.com/Freetrial.php

0 comments:

Post a Comment